Pakistan secures a global advantage for 100% cotton costs, but regional logistics frequently push total lead times past 60 days. Sourcing teams must weigh these significant margin gains against the risk of inventory delays common to the region.

This guide examines the production capacity of industry leaders. We also contrast the 25-35 day manufacturing cycles in China against Pakistani timelines and detail how Changhong’s prototyping services reduce administrative lag.

Pakistan’s Denim Industry Overview

Pakistan’s denim industry is a key player in the global textile market, contributing nearly 60% to the country’s total exports. The sector benefits from cost-effective production due to abundant local cotton and competitive labor rates, making it an attractive sourcing destination.

- Global Market Position: Pakistan is the second-largest denim exporter globally, just behind China, and supports large-scale programs for major retailers worldwide.

- Transition to Value-Added Production: While the industry has historically focused on volume, a shift towards higher-quality, value-added production is underway. Factories are investing in new technology and capacity to meet evolving global fashion demands.

- Vertical Integration: Most denim production is concentrated in industrial hubs like Karachi and Faisalabad, where the supply chain is tightly integrated, improving efficiency and reducing costs.

Despite some logistical challenges, Pakistan offers cost-effective pricing for buyers, especially for basic cotton programs, with attractive duty benefits for European buyers through GSP+.

Soorty Enterprises

- 📍 Location: Karachi, Pakistan; Bangladesh

- 🏭 Core Strength: Denim fabric, Jeans, Twills, Yarn

- 🌍 Key Markets: Europe, Global

Soorty operates as a fully vertically integrated complex, overseeing the entire denim production process from raw materials to finished products. With massive production volumes of 5.5 to 6.5 million meters of fabric and nearly 3 million garments monthly, they support major brands like G-Star, Diesel, Tommy Hilfiger, and Zara. Their advanced in-house R&D teams specialize in washing and finishing, enabling them to deliver complex denim treatments at scale.

However, their high-volume operation means they typically require large minimum order quantities (MOQs), making them less suited for small labels. Additionally, lead times reflect their scale, which may result in longer production cycles.

Artistic Milliners

- 📍 Location: Karachi, Pakistan

- 🏭 Core Strength: Automated Denim & Garments

- 🌍 Key Markets: EU, US

Think of this facility as a massive engine for the global denim trade. Artistic Milliners produces around 66 million meters of fabric and over 21 million finished garments annually. Their near-vertical integration, spanning from spinning to the final wash, ensures consistent, large-scale production of standard 100% cotton 3/1 twills. This structure also enables the integration of sustainability measures directly into the production process. While they focus on high-volume orders, their high minimum order quantities (MOQs) make them best suited for brands seeking reliable, large quantities rather than niche weaves.

Crescent Bahuman Ltd (CBL)

- 📍 Location: Punjab, Pakistan

- 🏭 Core Strength: Denim garments, Jeans

- 🌍 Key Markets: Europe, US

Crescent Bahuman Ltd (CBL) operates a massive integrated facility in Punjab, focusing on finished denim garments rather than merchant fabric sales. Think of their setup as a complete kitchen for jeans, not just a grocery store for ingredients. With full vertical integration, CBL provides a direct solution for brands needing ready-to-wear products rather than raw materials.

Their infrastructure makes them a strong FOB value source, particularly for brands sourcing for the European and US markets. CBL specializes in 100% cotton “value” jeans, offering a balance of cost and consistency for high-volume orders. However, their focus is mainly on value-tier cotton rather than premium fabrics.

US Group

- 📍 Location: Lahore, Pakistan

- 🏭 Core Strength: Denim, Knitwear, Apparel

- 🌍 Key Markets: Global

US Group handles a diverse mix of denim, knitwear, and general apparel for international markets. Think of them as a versatile department store for production, offering a wide range of clothing lines under one roof rather than a specialized boutique. Their infrastructure supports large retail programs, making them a reliable option for brands needing scale and variety.

With proven experience working with global retailers, US Group’s capacity remains undisclosed, but their track record suggests significant throughput capabilities. However, due to their scale, they often require higher MOQs, which may not be ideal for smaller brands.

AGI Denim (Artistic Fabric & Garment Industries)

- 📍 Location: Karachi, Pakistan

- 🏭 Core Strength: Vertical Denim Manufacturing (Mills + Garments)

- 🌍 Key Markets: Global

AGI Denim operates as a massive vertical setup in Karachi, with an annual output of 50 million meters of fabric and 25 million garments. Think of them as a heavy-duty engine for denim production, offering massive capacity and a fully integrated supply chain. Their scale allows brands to negotiate better pricing on high-volume orders, particularly for basic 100% cotton 5-pocket jeans. However, their high MOQs make them less suited for small batch runs or brands with lower volume needs.

Rajby Industries

- 📍 Location: Karachi, Pakistan

- 🏭 Core Strength: Denim garments

- 🌍 Key Markets: Export markets

Rajby Industries operates as a significant medium-to-large exporter based in Karachi. They focus heavily on the production of denim garments, catering primarily to international buyers looking for established manufacturing partners in Pakistan.

Think of them as a black box for capacity that requires a key to open. Since they do not publish exact output figures, you cannot simply look up their availability online. You will need to reach out directly to request their current capacity sheets to ensure their schedule fits your production planning.

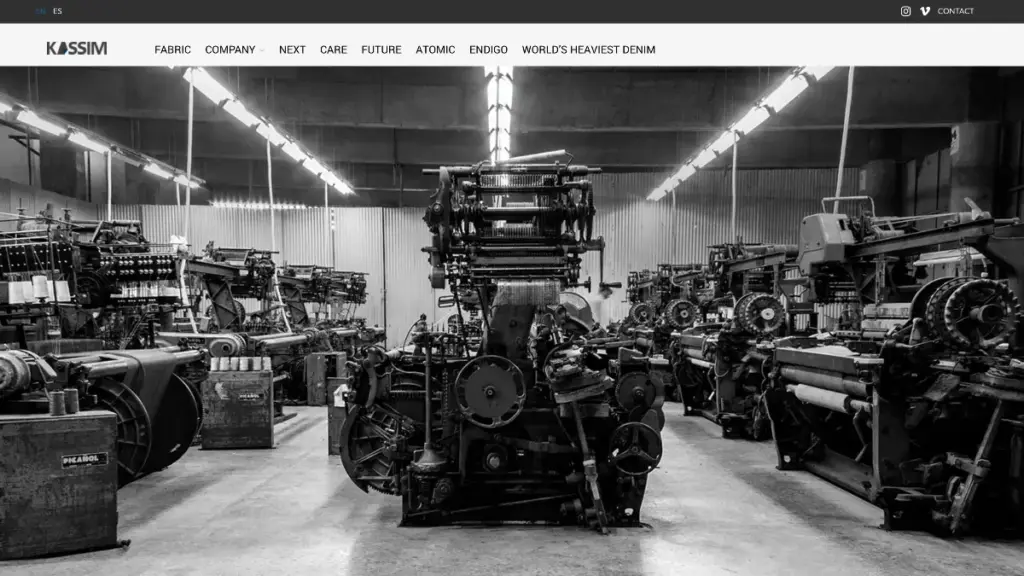

Kassim Denim (Kassim Textiles)

- 📍 Location: Karachi, Pakistan

- 🏭 Core Strength: High-volume denim fabric production

- 🌍 Key Markets: Global Export

Kassim Textiles, operates as a fabric mill with a reported annual production capacity of 30 million meters, specializing in 100% cotton denim fabric. This focus on raw material production allows them to provide large quantities of fabric to brands seeking consistent output for export markets.

Rather than offering a complete garment, Kassim provides the raw denim—much like a lumber yard supplying wood for a furniture maker. Brands often source their fabric to lock in material costs, then send it to a separate cut-and-sew facility for assembly. This approach gives companies more flexibility and control over their supply chain costs.

SM Denim

- 📍 Location: Pakistan (likely near Karachi)

- 🏭 Core Strength: Denim

- 🌍 Key Markets: Global Export

SM Denim is a mid-tier facility offering more direct engagement and flexibility compared to larger competitors. Their smaller scale allows for lower MOQs, making them an attractive option for smaller brands. While they specialize in basic fabrics, you should keep an eye on production schedules—tight loom availability may lead to longer lead times if the mill reaches capacity.

Siddiqsons Ltd

- 📍 Location: Karachi, Pakistan

- 🏭 Core Strength: Denim

- 🌍 Key Markets: Global

Siddiqsons, a veteran denim manufacturer in Karachi, leverages decades of experience and deep supply chain relationships to maintain steady production flows. Their long-standing market presence allows for faster cycle times on running fabrics, as they often have ongoing fabric lines for major accounts, enabling brands to slot orders into existing capacity. This results in shorter production timelines compared to starting from scratch.

However, their legacy systems may lack the agility of newer facilities, and higher MOQs for custom fabrics are common, making them better suited for larger orders rather than small-batch runs.

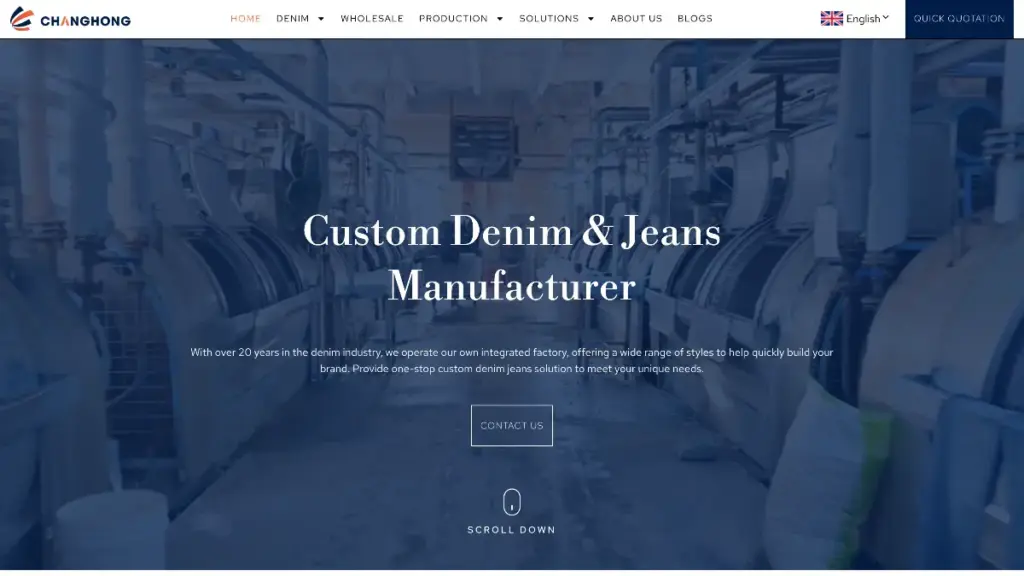

Guangzhou Changhong (China Alternative)

- 📍 Location: Guangzhou, China

- 🏭 Core Strength: Denim fabric (fashion and workwear)

- 🌍 Key Markets: Global

In addition to the factories mentioned above, we offer another reliable option: Changhong. Based in Guangzhou, Changhong operates on a significant scale, producing tens of millions of meters of denim annually.

While their labor costs are higher than those in regions like Pakistan, they make up for it with faster production timelines and efficient lead times, typically between 30 and 45 days. This makes them an ideal choice for brands looking to restock inventory quickly without waiting for longer, lower-cost production cycles.

Pakistan vs China: Shipping Time Comparison

When sourcing denim, lead time is the combination of production and transit duration. While shipping time is often the focus, factory delays can significantly impact the timeline.

Factory Production Lead Times

China generally offers consistent 25–35 day production cycles for standard denim, thanks to highly integrated supply chains. In Pakistan, production typically takes 30–45 days, but delays from factors like energy disruptions or raw material approvals can push timelines beyond 60 days.

Sea Freight Transit

- US West Coast: China (15–18 days) is faster than Pakistan (25–30 days).

- US East Coast: The difference narrows; China (28–32 days) vs. Pakistan (30–35 days).

- Europe: Pakistan (22–28 days) often ships faster than China (28–35 days).

- Middle East: Pakistan leads with 3–7 days, while China takes 10–14 days.

For U.S. buyers, China remains faster overall, particularly for West Coast shipments. However, European buyers can benefit from Pakistan’s shorter sea transit times to ports like Rotterdam and Hamburg. That said, production delays in Pakistan can sometimes offset these advantages.

To mitigate these risks, Changhong’s One-Stop Cooperation Process optimizes production and logistics, ensuring smoother timelines and reducing the chance of delays.

Checklist for Verifying Pakistan Factories

| Factory | Location | Main Products | Pros | Cons |

|---|---|---|---|---|

| Changhong | Guangzhou, China | Denim fabric, finished garments | Fast production times, large-scale capacity, efficient logistics | Higher labor costs compared to other regions |

| Soorty Enterprises | Karachi, Pakistan | Denim fabric, finished garments | Full vertical integration, advanced in-house R&D, proven with top brands | High MOQs, less suited for small labels |

| Artistic Milliners | Karachi, Pakistan | Denim fabric, finished garments | Massive production capacity, advanced washing/finishing, proven brands | High MOQs, best for standard twills over niche weaves |

| Crescent Bahuman Ltd | Punjab, Pakistan | Denim fabric, finished garments | Reliable FOB value source, strong vertical integration, cost-effective | Best suited for value-tier cotton, high MOQs |

| US Group | Lahore, Pakistan | Denim, knitwear, general apparel | Versatile product mix, proven experience with global retailers | Higher MOQs for small brands, exact capacity undisclosed |

| AGI Denim | Karachi, Pakistan | Denim fabric, finished garments | High production capacity, price negotiation on volume basics | High MOQs for best rates, less suited for small batch runs |

| Rajby Industries | Lahore, Pakistan | Denim fabric, finished garments | High-volume production, competitive pricing | Limited product variety, high minimum order quantities |

| Kassim Denim | Karachi, Pakistan | Denim fabric | Massive fabric capacity, cost control via fabric sourcing | Requires separate sewing partner, high MOQs for milling |

| SM Denim | Karachi, Pakistan | Denim fabric, finished garments | Flexibility on MOQs, direct engagement | Tight loom availability may lead to longer lead times |

| Siddiqsons Ltd | Karachi, Pakistan | Denim fabric, finished garments | Faster cycle times on running fabrics, deep supply chain relationships | Legacy systems may lack agility, high MOQs for custom fabrics |

Final Thoughts

Pakistan is a powerhouse for cost-effective cotton production, but relying solely on large mills can expose brands to significant calendar risks. The key is balancing scale with agility.

By combining Pakistan’s volume with Changhong’s rapid prototyping and efficient logistics, you get both competitive pricing and speed to stay ahead. Changhong offers the flexibility you need for smaller batches and tighter deadlines. Contact us today to streamline your sourcing process and meet your production goals faster.

Frequently Asked Questions

Who is the biggest denim manufacturer in Pakistan?

Artistic Milliners is widely recognized as the largest manufacturer by export value and vertical capacity. In 2024, they recorded textile exports of approximately PKR 104 billion, supplying major global brands like Levi’s and H&M.

They operate like the anchor of the local industry, setting the benchmark for volume and integrated production capabilities.

What is the MOQ for Pakistan factories?

Most factories quote between 50 and 300 pieces per style. Small brands can often find partners for 100–150 pieces, though some specialists accept 50 pieces at a higher unit cost. Larger export-oriented facilities typically require 300+ units for competitive pricing.

It works similar to wholesale club pricing; committing to higher volumes unlocks significantly better rates per unit.

Is Pakistan denim better than Chinese?

It depends on the product. Pakistan is generally better and cheaper for 100% cotton basics and heavy workwear due to domestic cotton availability. China typically offers better reliability for complex fashion denim, advanced finishes, and shorter lead times.

Imagine Pakistan as the specialist for heavy-duty foundation materials, while China excels at intricate details and speed.

How long does shipping take from Karachi?

For international orders, total production plus shipping often takes 8–12 weeks (60+ days). However, local logistics are fast; moving goods from a factory to a warehouse or port within Karachi typically takes just 1–5 working days.

The process resembles international mail versus a local courier; the long haul accounts for most of the timeline, while the first mile is quick.